Buy the right Sage software products for you…

Getting the right software is key to the smooth running of your company accounts. We can give you advice on all Sage software products and help you make the right decision. A brief description of the software available is listed below – don’t forget that if you do not see the software you need or need more advice please call us on 01691 684011, or contact us here.

If you’d like more information or would like to request a software demonstration, click here

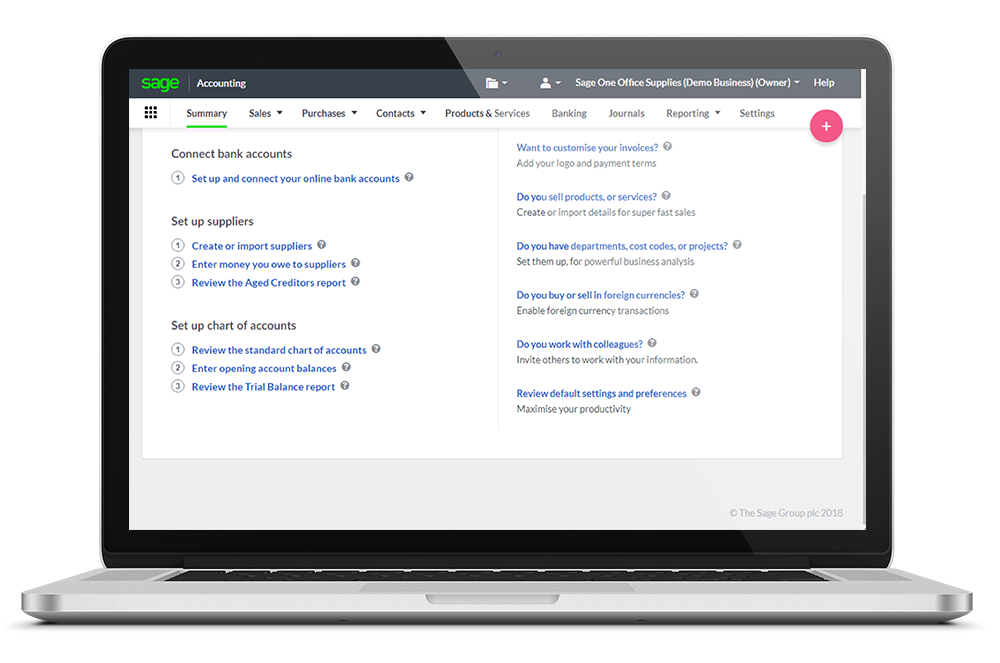

Sage Business Cloud – Cloud based programs

Super-easy, everything you need to take care of business, help to free yourself from admin with clever, easy-to-use features built around you. Can be used on your computer, tablet and mobile phone.

Sage Business Cloud Accounting Start

- Create Sales invoices in seconds

- Sell products and services

- Track what you are owed

- Connect to your bank – record money in and out

- Reports and insights

- Take care of VAT

- Mobile apps

Sage Business Cloud Accounting Standard

- Multi-user

- Cashflow forecasts

- Quotes and Estimates

- Create product records for non-stock items and services

- Purchase invoices – record invoice from suppliers and track what you owe.

- Multi-company

- Multi-currency invoicing – invoice international customers in their own currency.

- Analysis types – set up departments, cost-centres and projects

- Pro-forma Invoices

- Customer statements

- Remittance advices

- Credit notes for returns

- Delivery notes

- CIS and subcontractors

Sage Business Cloud Accounting Plus

- Multi-currency functionality

- Create product records, stock items and manage stock

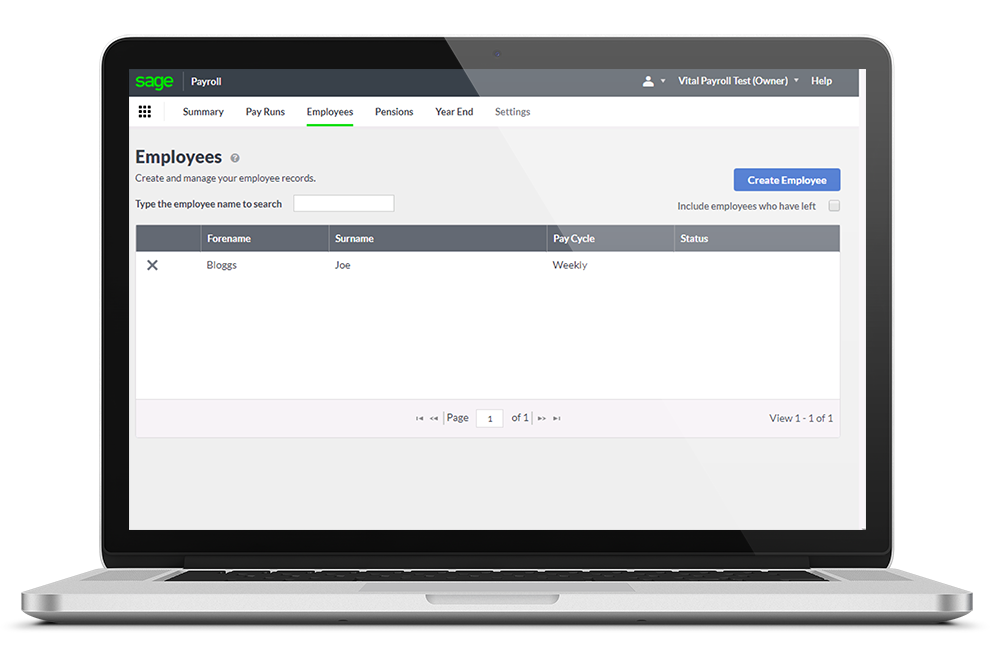

Sage Business Cloud Payroll

- Very easy – no experience required.

- Includes the latest legislation.

- Support 24/7 (Direct with SAGE)

- Payments and deductions – simple 4-step pay run. Enter hourly pay or salaries

- Pay staff weekly, 2-weekly, 4-Weekly and Monthly.

- Real Time Information – submit your PAYE & NI data to HMRC in just a click. Also GDPR ready.

- Workplace pensions – guides you through the process, automatically access your workforce and does all the calculations for you.

- Easy corrections – designed to help prevent mistakes and errors can be easily corrected.

- Payslips, P60s and more – print, email or view online payslips, P60s and other reports. No pre-printed stationery required.

- Deal with Cycle to Work Schemes, Childcare vouchers etc.

- Post wages payments etc. direct to Sage Business Cloud Accounting

- Salary journals

- Available for up to 100 employees

If you’d like more information or would like to request a software demonstration, click here

Sage 50 Accounts Range

Sage 50 Accounts Standard

- Up to 10 companies

- Up to two users (additional cost)

- Track and manage stock

- Track project income, expenses and profit

- Manage multiple departments and budgets

- Includes Office 365 and support

- CIS module (additional cost)

- Foreign trader (additional cost)

If you’d like more information or would like to request a software demonstration, click here

Sage 50 Accounts Professional

- Unlimited number of companies

- Up to twenty users

- Create Sales and Purchase orders

- Stock Shortfall

- Bill of Materials

- Trade in multiple currencies

- Batch supplier payments

- Customer and Supplier price lists

- Intrastat returns

- Automatic prepayments, accruals and fixed asset register

- Includes up to 24 Sage Drive Users

If you’d like more information or would like to request a software demonstration, click here

Sage 50 CIS

Leave the hard work on site.

- Comply with the latest regulations

- Seamless processing and submission of CIS returns direct to HMRC in just a few clicks.

- Amend and resubmit at a touch of a button

- Easily enter batch supplier transactions

- Quick and easy processing of subcontractors invoices and payments

- All your CIS transactions safely stored and recorded in one place

- Record the correct information and ensure you deduct the correct tax rates

- Automatically produce your monthly sub-contract payment statements.

If you’d like more information or would like to request a software demonstration, click here

Sage 50 HR

- Import employee information from Sage 50 Payroll

- Convert employee data held in Sage Personnel to Sage 50 HR

- Record different types of absences, from holiday through to sickness and the date range of absence.

- Set up user defined absence reason, for example migraine or flu etc

- Record details of whether the absence is work related, if a doctor’s note has been provided

- Access rights by tab

- Advanced data import

If you’d like more information or would like to request a software demonstration, click here

Sage 50 Payroll

Desktop Software.

- Easy set-up wizard to get you started

- Simple to use

- “Show me how” videos to guide you through common tasks

- Process weekly, two-weekly, four-weekly and monthly payroll

- Choose from a range of payslip layouts

- Print or email payslips to employees or via online portal

- Automatically calculate payments and deductions

- Calculate and process employee loans

- Record and calculate holiday pay

- Record and calculate Salary Sacrifice deductions such as childcare vouchers and Cycle to Work scheme.

- Connect with Microsoft Office by importing your existing data from a CSV File

- Link your payroll software directly to Sage 50 Accounts and transfer your data in a few simple steps

If you’d like more information or would like to request a software demonstration, click here

Not all accountants are grey.

Call us now for your FREE consultation on 01691 654545 or click here...